This is the first of a three part series detailing the key topics that institutional investors are talking about on Facebook (FB). Facebook will report earnings on Wednesday, November 4.

Part 1: Detailing FB's Near-Term Revenue Drivers

Part 2: Detailing FB's Longer-Term Revenue Drivers and the Bear Case

Part 3: What Investors are Focused on Ahead of FB's 3Q Results

Facebook is Loved by Wall Street

Facebook is considered one of the most crowded longs currently with a long list of hedge funds piled into the stock, an average "Outperform" rating among sell-side coverage, and a 43x NTM PE multiple. Over the following three days, I'll detail the general bull thesis, bear thesis, and 3Q outlook.

The FB bull thesis is made up of a number of revenue drivers that could drive advertising revenue and EPS upside. In the near-term, investors see a number of positives that could benefit sales, including easing comparisons and FX headwinds. Beyond these superficial tailwinds, investors are most bullish on the opportunities from video and Instagram, which are not fully baked into consensus estimates for next year.

Video Could Drive Additional Gains in FB Monetization

FB is in the early innings of a maturing advertising platform, and investors expect video to speed up the maturation process by driving additional advertisers to the platform and increasing CPMs (cost per impressions). In total, investors see the video opportunity as an additional 5% - 15% upside to revenue and EPS consensus estimates in 2016.

Let's take a step back and give a brief overview of Facebook video. Facebook currently auto plays videos that are uploaded directly onto their platform. The auto play feature leverages Facebook's huge audience, drives heavy user engagement, and incentivizes content creators to upload videos to Facebook. While videos are relatively new to Facebook, the platform has already generated over 4 billion video plays. The ALS ice bucket challenge was a big catalyst of this, as videos spread quickly over the network and 'trained' users to Facebook's new feature.

Going forward, investors believe companies will increasingly run video ads on Facebook as they realize the tremendous value that the platform brings. Facebook's platform offers unprecedented reach, with over 1.5 billion monthly active users. Additionally, these users are highly engaged and often watch the entirety of the video.

As an example, Ford ran a highly successful mobile video campaign targeted towards a Hispanic audience. The campaign reached 27% of all US Hispanics 18 and older, saw a 6x higher click-through rate than average Facebook automotive campaigns, and also saw a 71% completion rate of video views.

As another example, Heineken also ran a highly successful video ad campaign that generated a 12% brand awareness lift and reached 54% of its audience in three days. As the Senior Media Director at Heineken noted, "most TV networks don't get these numbers." Furthermore, with many companies already used to running video ads traditionally through TV networks, many investors believe that Facebook's new video capabilities may draw more of the traditional advertisers that have not yet made the switch to digital or onto Facebook.

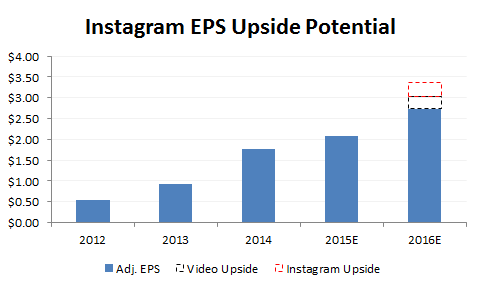

What is the potential impact to Facebook's financials? Analysts generally estimate the contribution to be roughly $1 billion - $3 billion in 2016 revenue, or a ~5% - 15% contribution to sales. Assuming margins at its current level, this would translate into a $0.15 to $0.40 contribution to EPS, or a ~5% - 15% contribution to EPS growth from current consensus estimates of $2.74. While consensus estimates probably bake some of this benefit already into projections, the contribution is still likely to be significant.

Instagram Following FB's Path to Monetization

The second near-term source of revenue and EPS upside is the increasing monetization of Instagram. Here, investors believe that Facebook will gradually open up the platform to advertisers, which could drive additional revenue and EPS upside of ~8% - 15%.

Instagram has been one of the best examples of Facebook's great acquisitions. Instagram recently announced that they've surpassed 400 million users, representing significant growth from the 90 million users reported by the company in January 2013. Additionally, the platform has been hugely popular among younger age groups - a historical area of weakness for Facebook. However, despite its success, Facebook has been slow to monetize the platform as it has been focused on improving the experience and growing the user base.

More recently, Facebook has finally begun to ramp up ads on Instagram. Initial results have been largely positive, with many companies reporting strong reach, consumer engagement, and ad recall. Management is currently working on growing advertiser tools by creating more direct-response advertising formats (like carousel ads, app installs, and video ads), increasing targeting capabilities, and allowing for advertisers to buy through the platform or through third party planners. With the tools increasingly in place, a large and growing base of users, and Instagram noting that consumers will see more ads in the near-future, investors are looking for Instagram to become a more significant part of revenue growth over time.

How much could Instagram contribute to revenue and EPS? The street generally expects ~$2 billion - $3 billion in revenue, or ~8% - 15% revenue contribution. Assuming similar profit margins, this would translate to an additional ~8% - 15% EPS growth above consensus estimates.

In total, both Instagram and Video represent ~10% - 30% EPS upside from current consensus estimates. As Facebook reports quarterly earnings results demonstrating traction from these two sources, investors believe estimates and the stock will start to move higher.

Beyond these two sources of revenue growth, investors also expect longer-term contributions from messaging (FB Messenger and WhatsApp) as well as Oculus. Tune in to my next post where I'll describe these initiatives in more detail, as well as the bear case behind Facebook.