Summary

On Thursday, Biogen presented additional aducanumab data at CTAD that answered some questions, and raised others

Bulls believe the totality of the data, including the first positive pivotal trial in Alzheimer’s, is supportive of approval

Bears believe the data is too confounding to receive approval

Potential considerations beyond the stats could also potentially shift the odds of approval in Biogen’s favor

Drug approval could add over $10B in gross revenue, but investors should consider the potential for a more narrow label

Unpacking the Bull and Bear Thesis

For those who are not familiar with my writing, I write about both the bullish and bearish arguments put forth by institutional investors, sellside analysts, and industry participants that I have exposure to. These arguments are often not public given the tightly-controlled walls in finance. Hearing both sides help you come to your own conclusion about the appropriate investment decision, or to reinforce/challenge your own existing beliefs about the company. Note that I do not have a strong opinion on Biogen, or on most of the companies I write about (save for a few names, in which case I try to explicitly separate my own view).

Investors familiar with Biogen are likely weary of their pursuit of the first disease-modifying drug in Alzheimer's, specifically with aducanumab (I will save a discussion of BAN2401 for another time). However, for those who are involved in the stock, or who are looking for an opportunity to gamble, the topic is crucially important to understand where Biogen stock might go next.

On Thursday, Biogen presented highly anticipated data on aducanumab at Clinical Trials on Alzheimer's Disease (CTAD) that detailed some of their reasons for pursuing an aducanumab submission and why two ph.3 trials saw such different results. The data was largely not convincing enough for either side to switch stances, leaving the debate up in the air.

The results, like BAN2401, are a doozy to analyze and, without question, difficult to arrive at a conclusion with high certainty. However, that also presents the opportunity, as the market uncertainty leaves significant upside/downside to someone who can successfully predict the outcome.

For the bulls, they are cautiously optimistic that the drug could see approval due to: 1) the totality of the data, including the first, clear, disease-modifying ph. 3 trial success in Alzheimer's and another ph.3 trial that is supportive when analyzing subgroups, 2) Biogen noting that the submission was done in consultation with the FDA, and 3) the high, unmet need from Alzheimer's and the political/societal ramifications that could lower the bar for approval.

For the bears, they see the same data and argue that: 1) one ph. 3 trial looks confusing at best, and refutative at worst, 2) even when looking at the subgroup analysis, effect size looks small and potentially skewed by APOE4 imbalances, and 3) FDA consultation is never an explicit blessing or approval.

Background

Aducanumab and Biogen's pursuit of an Alzheimer drug has been detailed in numerous articles, so I'll keep the background short.

Biogen's aducanumab was seen as potentially the most promising asset within their Alzheimer's portfolio, along with BAN2401. Both drugs are pursuing the amyloid hypothesis, which is the belief that amyloid beta is a major contributor to the progression of Alzheimer's disease. For a primer on Alzheimer's, see my prior writing in mid-2018 that looked at Biogen's other Alzheimer's drug, BAN2401.

In early 2019, Biogen discontinued its two ph. 3 trials, ENGAGE and EMERGE, studying aducanumab in Alzheimer's disease, after futility analysis showed that the studies were not likely to meet its primary endpoints. The stock dropped and investors assumed aducanumab was dead.

Then, in late October, Biogen announced that they would be pursuing a filing after all for aducanumab after further analysis showed that EMERGE met its primary endpoint, and that ENGAGE showed supportive evidence in a subset of its patients. This was an unprecedented move, shocked industry participants, and revived the debate around the drug. Many investors were looking forward to Biogen's presentation of additional data at CTAD, which was disclosed on December 5th, but most analysts and investors I've spoken to did not incrementally change their view too significantly one way or the other after the presentation.

If You Squint Hard Enough, the Data Might Be Good Enough For Approval

Let's first look at the arguments in support of, and against, the data from the two trials.

It's generally agreed upon that EMERGE data looks strong. Management argues that their new analysis uses a larger dataset (n=2,066 with 18 month follow up) vs. the prior futility analysis (n=1,748). The new analysis showed that EMERGE met its primary endpoint with a 23% reduction in CDR-SB (p=0.01) at 78 weeks vs. placebo at the highest dose. This coincided with significant reductions in amyloid plaque. EMERGE also had statistically significant p-values on secondary endpoints ADAS-Cog, ADCS-ADL-MCI, and almost on MMSE. It should be noted that this is the first positive ph.3 pivotal trial for a disease-modifying drug in Alzheimer's.

Of note, some bears have expressed concern on the small sample size and imputation; only 55% of patients randomized to the high dose arm were still in the study at week 78.

With that said, the debate is primarily focused on ENGAGE data. ENGAGE's highest dose arm trended worse than placebo on CDR-SB and MMSE even though they showed an amyloid PET reduction. The miss on the primary endpoint looks odd given that ENGAGE and EMERGE were similarly designed.

However, management argues this was due to protocol changes put into place, which they detailed at CTAD on Thursday. Additional insights from PRIME (their ph. 1b trial studying aducanumab) led management to implement a protocol amendment (PV4) in the study, with a goal of getting more patients to titrate up to the 10 mg/kg dose. This protocol amendment led to interrupted patient dosing. As a result, management argues that the incorrect futility analysis was a result of not enough patients receiving the minimum exposure requirement at the high dose. Upon further analysis of the post-PV4 patients who did receive the minimum exposure requirement, outcomes appeared consistent with EMERGE results. Management's slides at CTAD were largely aimed at proving this point.

Source: Biogen CTAD 2019

Bulls, and even numerous bears, believe that management's explanation makes sense, and it should be noted that the FDA has allowed subgroup analysis in considering efficacy in Alzheimer's.

Another factor to consider is the developmental history of neuroscience drugs. Neuroscience drug development is notoriously difficult, and the FDA appears to acknowledge this when determining whether to approve a drug. as there have been numerous approved drugs in neuroscience that have failed prior pivotal trials. In 2019 alone, two drugs that received approval failed a pivotal trial (Mayzent and Spravato).

Physician panelists at CTAD also spoke positively about the drug and their willingness to overlook the confusing ENGAGE data, which may have led to the positive stock reaction for the day. While their willingness might not be statistically sound, it speaks to the urgency within the field to address an area with a high unmet need. There's also a belief among key opinion leaders (KOLs) that the bar to show clinical effects and biomarkers in Alzheimer’s is simply too high, the endpoints are not sensitive enough, and not enough weight is put on quality-of-life improvements.

The physicians' positive response to the results could be considered by an advisory committee in the future, which would be another factor in favor of approval. Beyond the panelists, KOLs more broadly appear to be fairly supportive of the drug as well, with KOLs interviewed by numerous sellside analysts expressing optimism for the drug. However, many also were careful to note the complication of the data as well, which obviously works against aducanumab’s case.

There's numerous counterarguments to the data in ENGAGE, and it depends on what data you choose to focus on. The biggest counterargument is the simple fact that the highest dose is worse than placebo on CDR-SB. Management's explanation appears to be somewhat arbitrary and a retrospective attempt to fit a conclusion into the data. Effect sizes that were observed also appeared to be small. Furthermore, without disclosure of APOE4 carriers at CTAD, it is thought that APOE4 carrier imbalances between placebo and treatment could have resulted in some of the signal (for a more detailed discussion of APOE4 and its impact on patients with Alzheimer’s, see my article on the fun details of BAN2401). Furthermore, it does appear that the placebo group in EMERGE performed worse than the placebo group in ENGAGE, which may have also contributed to the signal shown in EMERGE. Ultimately, bears believe that this confluence of inconsistencies in the data presents enough for the FDA to not give approval to aducanumab, or at a minimum, request additional trials.

How Meaningful is FDA Consultation?

Biogen noted that the new analysis was conducted "in consultation with the FDA," and that "based on discussions with the FDA," they would plan to file a BLA in early 2020. Management noted that they had two Type C meetings with regulators prior to their decision to file. The key question is to what degree did the FDA "bless" the submission, and if so, how meaningful that might be. In some ways, this could be the more important swing factor for approval, as there is general agreement that the data from the trials is complicated and uncertain.

One factor to consider is that analysts generally hold Biogen management in high regard, and believe that they would not risk their career and credibility on a vague or loosely-interpreted signal from the FDA.

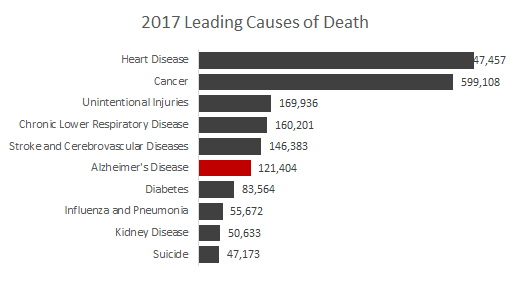

And, as noted previously, Alzheimer's presents a number of additional considerations beyond the usual statistical analyses. Alzheimer's is the sixth leading cause of death in the US, and it's growing significantly with a 145% increase between 2000 and 2017. The FDA wants to incentivize companies to pursue drugs in this space at a time when many companies are exiting neuroscience drug development (i.e. Amgen, AstraZeneca, Pfizer). Shooting down a drug with the first successful pivotal trial, and (arguably) supportive data in the other ph.3 trial, would be counterproductive to this aim.

Source: Center for Disease Control

However, bears have responded to these points by noting that the FDA is under no obligation to approve a drug, nor should they be considering additional factors if the drug doesn't show supportive data. Additionally, the whole aducanumab ordeal has destroyed management's credibility in the eyes of many investors. For example, the fact that their original futility analysis was incorrect, and some of the steps that led to it (i.e. protocol changes), begs the question: why was the futility analysis wrong in the first place?

Impacts to Valuation

How is the street modeling and thinking about aducanumab's impact to revenue, and ultimately, to the target price of the stock? Recall that analysts calculate a risk-adjusted revenue estimate for each drug, discounted by the analyst's estimate for probability of success (POS). In aducanumab's case, my read is that most sellside analysts, and buyside investors, have a POS of around 30%, with lows at 0% (some bears refuse to put it into their model), and highs at 50%.

In terms of gross revenue, analysts forecast sales of $10 billion or more, with a high patient population and high price with no competition in the space driving those numbers. On a risk-adjusted basis, consensus currently expects about $3 billion by 2025, and $4.8 billion by 2028. Remember that risk-adjusted revenue is discounted by the probability of success estimates mentioned above.

Another factor to consider is that analysts are now considering the odds that the drug receives a more narrow label upon approval given the high dose requirements. If this ends up being the case, estimates may come down.

The full impact of consensus estimates to the stock price could potentially drive shares to $370 or more (24%+) based on a DCF analysis incorporating the revenue additions detailed above. On the flip side, rejection would move the stock back down to the $220 level (-25%) where the stock was prior to the announcement.

A Messy Affair but Opportunities for Those Who See A Likely Outcome

Accurately predicting the FDA’s decision on aducanumab is a messy affair that could swing based on your point of focus. For bulls, they are focused on the totality of the data, the successful EMERGE trial, and the subset of data in ENGAGE that is supportive. For bears, they are focused on the primary endpoint miss in ENGAGE, the small effect size, and other factors that could have led to that signal. Beyond the stats, there are other considerations to account for, including the high unmet need in Alzheimer’s. If you can come out of the aducanumab knot with a firm view on one side or the other, then Biogen presents an interesting trade opportunity as the company looks to file the BLA in 1H20 and approaches a likely advisory committee hearing in 2H20.