Key Issue 1: With the new Alphabet structure, how will the stock be revalued?

Investors are debating how Google's new reporting structure will impact valuation. Recall that the new Alphabet structure will disclose its core search business as a separate business unit from its other "moonshot" projects in 4Q15. With the new disclosures, investors will learn two things: 1) how profitable is Google's core search business, and 2) how much is Google spending on their other projects. Investors could then apply a sum of the parts valuation to each piece to arrive at a new Google valuation.

What are current expectations? Expectations seem to hover around a total Google valuation somewhere in the $800 - $900 range. This assumes the Google core business makes up the majority of that value (using a 15-20x multiple on EBITDA) and a small positive value coming from their moonshot projects. While these projects are estimated by the Street to be losing somewhere between $2 - $8 billion, the thinking is that these projects are worth something given the amount of traction and future growth potential that some of them have generated.

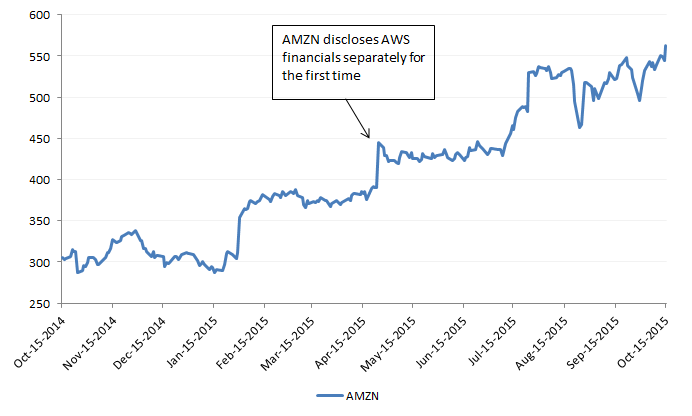

The situation is somewhat similar to Amazon's when they reported their AWS business separately. The new disclosures revealed an AWS business that was significantly more profitable than investors expected, which shot AMZN stock significantly higher. The key message: new disclosures can cause a radical change in how investors view and value a stock.

Key Issue 2: How will the core Google search business fare in 3Q?

While the implications of new disclosures has dominated investor discussion, numerous analysts have reminded investors to not ignore Google's core search business, which still represents 90%+ of its total revenue. Investors expect positive trends in the core business due to 1) YouTube revenues ramping up as it takes more share of ad budgets, 2) outperformance in mobile as Google increased its ad load from 2 to 3 in the quarter, and 3) easier comparisons from one year ago when the company faced difficult FX trends. These factors have led to consensus expectations for revenue acceleration in 3Q15 (see image below), with some analysts calling for further upside to this estimate.

Consensus estimates for consolidated GOOGL imply an acceleration in 3Q