- Lyrica sales are expected to erode significantly over the next two years as generics enter the market.

- Pfizer’s pipeline has strengthened significantly over the last several months and has a number of opportunities that could offset these losses and drive mid-single digit growth in the coming years

- Specifically, Ibrance, Xeljanz, Xtandi, Tanezumab, and Tafamidis represent significant opportunities that could drive growth for Pfizer

Pfizer Looks Set to Outrun the Treadmill

I think of most pharma companies as on a constantly-running treadmill. As their prized drugs approach the end of their patent life, the treadmill begins to speed up. And in order to keep up, pharma companies must continue to invest in the pipeline and ensure that new drugs and line extensions will offset those losses once generics start taking share.

Pfizer for the last several years has been a story of the treadmill speeding up. In 2015, it lost patent protection for Enbrel (outside of the US). In 2017, it lost Viagra patent protection. And in June, Pfizer will lose Lyrica patent protection in the US. Pfizer has managed around these losses, maintaining sales levels. But it also hasn't been able to grow.

With 4Q results just reported and 2019 guidance issued, investors are now beginning to see the potential for a return to strong, mid-single digit growth. With a strong pipeline of new drugs and numerous line extensions, and reducing LOE pressures beyond 2020, expectations are beginning to rise. The company will need to execute across a number of key drugs to continue to outperform.

Lyrica Sales Erosion Coming, but Widely Expected

Lyrica is a drug used for the treatment of several indications, including diabetic peripheral neuropathy, postherpetic neuralgia, and fibromyalgia. Lyrica has been a hugely successful drug for Pfizer, and sales have continued to climb ahead of upcoming generic competition in June 2019. During their most recently reported 4Q18 results, management gave guidance for a $2.6 billion negative impact from loss of exclusivities (LOEs) in 2019. Much of this is expected to come from Lyrica, as consensus currently points to $1.8B in Lyrica losses in 2019, and another $1.6 billion in 2020.

While management’s guidance was negative, investors were bracing for the worst as the Lyrica patent loss was well known. And on the positive side, management highlighted their belief that they would enter a sustained era of top-line growth, driven by 1) a reduced level of LOE headwinds from 2021 until 2026, 2) favorable macro trends, and 3) a best-in-class pipeline. Judging by the stock reaction in recent months, investors have largely agreed with this. Since late July, the stock has run up 15% as Pfizer has seen a sudden strengthening in the pipeline driven by favorable readouts. I detail the major components that are expected to drive growth in the coming sections.

Growth to Come from Numerous Blockbuster Opportunities

Pfizer’s pipeline is among the best in its class. During the 2018 JP Morgan Healthcare Conference, management noted that they target up to 15 blockbusters in 5 years. Additionally, much of Pfizer’s pipeline of new drugs and line extensions 1) are in late stage trials, 2) have strong data from earlier trials, and 3) are first in class molecules.

Within the pipeline, I will focus on five new revenue opportunities: Ibrance, Xeljanz, Xtandi, Tanezumab and Tafamidis. For further background, see my prior article on Pfizer in July of last year.

Ibrance. Ibrance is an oral combination treatment for women with HR+, HER2- metastatic breast cancer. HR+, HER2- is a specific kind of breast cancer that represents roughly 60% of women with metastatic breast cancer. Recall that Ibrance is the first cyclin dependent kinase (CDK) inhibitor to receive approval, and was launched in 2015. Today, Ibrance is one of PFE’s largest drugs, generating $4 billion in revenue in 2018.

Growth within the US has tapered off as CDKs have begun to reach saturation. In 3Q and 4Q, Pfizer’s US Ibrance sales declined by 0.7% and 4.4%, respectively. Over 70% of newly started patients have received a CDK therapy, with the lions share of that going towards Ibrance.

Competition has also increased as Verzenio and Kisqali are taking share. However, the market continues to believe that Pfizer will hold onto most of the market with Ibrance’s best-in-class efficacy and safety. Verzenio has good efficacy and can cross the blood-brain barrier, thus making it effective for brain metastases. But these are rare cases that are estimated to represent less than 10% of HR+, HER2- patients. Additionally, the gastrointestinal side effects (diarrhea, nausea) present issues for patients. Meanwhile, Kisqali is burdensome for doctors due to its ECG monitoring requirements.

International remains the growth driver going forward. There has been strong uptake in Europe and in Japan. Ibrance also recently received approval in China and is expected to gain meaningful traction there. Thus, while US growth has tapered off, international has picked up the slack and has driven continued growth for Ibrance. As a result, global Ibrance sales grew 32% in 2018, and is expected to grow by 17% in 2019.

Further upside for Ibrance is expected to come from the early stage adjuvant setting for breast cancer. This is a crucial driver for Pfizer’s growth and a major focus among investors for several reasons. First, estimates from investors and key opinion leaders (KOLs) have placed the addressable market within the adjuvant setting at multiple times larger than its current addressable market. Second, the duration of the treatment is longer. Third, there is little competition in the near-term, presenting a significant opportunity.

Given high investor expectations and the revenue opportunity, a slip up would be harmful to Pfizer’s growth prospects. Some investors have expressed concern around neutropenia toxicity (lower neutrophils in the blood, leading to increased susceptibility to infection). Additionally, some KOLs have noted that the trials, which are 5 and 7 years in length, are short and could prove difficult to prove statistical significance given that early stage patients are in better health. While these concerns are not huge, they require close monitoring. Both the PALLAS and PENELOPE trials are expected to read out in 2020.

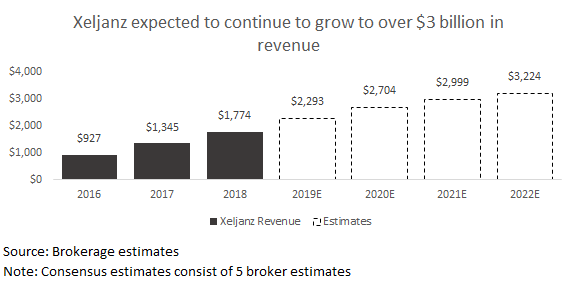

Xeljanz. Xeljanz is an oral janus kinase (JAK) inhibitor used for the treatment of rheumatoid arthritis (RA), psoriatic arthritis, and ulcerative colitis (UC). The UC indication was recently won in May of last year and will be crucial for the drug’s future growth given that they will be facing other JAK inhibitor competition in RA in 2019. Olumiant from Eli Lilly, Upadacitinib from AbbVie, and Filgotinib from Galapagos are all set to potentially enter the market this upcoming year. Within UC, Xeljanz offers an interesting oral alternative to existing treatments. However, it may take some time to gain traction as physicians are fairly comfortable with existing injectable and infused options. As a result, investors expect Xeljanz to gradually grow revenue as they gain a position within the UC market.

Investors have recently raised some concern around CV risk for Xeljanz and for JAK inhibitors at higher doses. On February 19, Pfizer announced that it had moved some patients taking the 10mg dose of Xeljanz for RA in the post-marketing study to a 5mg dose after observing the occurrence of pulmonary embolism. Some drugs within JAK inhibitor class have seen similar issues with pulmonary embolism, and there is some concern that the FDA could add additional warnings to the JAK class, which could slow sales growth.

Xtandi. Xtandi is a drug that’s used to treat men with advanced prostate cancer. The drug has grown well for Pfizer with 19% growth in 2018 and $700 million in sales, but investors are now watching to see how sales will be impacted by generic entrants in one of its main competitors, Johnson and Johnson’s Zytiga. So far, according to IQVIA data, generic Zytiga has taken share from branded Zytiga, but has not yet materially impacted Xtandi scripts.

Xtandi’s opportunity for growth is driven primarily by its move into non-metastatic castration resistant prostate cancer (nmCRPC). Xtandi received approval in July of last year for nmCRPC, making it the first oral drug approved for both metastatic and non-metastatic prostate cancer. According to Pfizer, the non-metastatic patient population roughly doubles the addressable market for Xtandi. While Johnson and Johnson’s Erleada has a first-mover advantage within this space, Xtandi has a similar efficacy and safety profile, and its penetration into clinics should help the drug gain traction. Pfizer is also pursuing several more hormone-sensitive prostrate cancer indications, including in metastatic hormone sensitive prostate cancer (with the ARCHER study, expected to read out in early 2020) and in non-metastatic hormone sensitive prostate cancer (with the EMBARK trial, expected to read out in late 2020).

Overall, Xtandi is expected to contribute over a billion in sales by 2021 and $1.5 billion by 2024.

Tanezumab. Interest around tanezumab has grown as the opioid crisis has worsened. Tanezumab is a nerve growth factor inhibitor used to treat pain. Given the strong need for a non-opioid alternative to chronic pain, the benefits from the drug are obvious. Management has noted that over 27 million Americans have osteoarthritis, and 23 million have chronic lower back pain (two of the indications that tanezumab is targeting). Pfizer has sized the potential tanezumab opportunity at over $1 billion.

The primary debate on tanezumab is not on the benefits, but on the safety profile. One of the adverse events is an elevated risk of treatment-related rapidly progressive osteoarthritis (RPOA). Management has several long-term safety trials reading out this year, with one reporting just last week. The most recent study met its primary endpoint of lower back pain intensity score at week 16 vs. placebo for the 10mg dose, but did miss statistical significance at 5mg. Importantly, the safety data was encouraging, as RPOA was observed in just 1.4% of patients. Additionally, rates were consistent at week 24 and week 80, suggesting that there was no exposure-response relationship.

Overall, the consensus among investors and KOLs seems to be that RPOA events are at an acceptable level, as three trials have now observed RPOA events at 1.5%, 2.1%, and 1.4% of all patients. Future readouts will examine tanezumab head to head against commonly used nonsteroidal anti-inflammatory drugs (NSAIDs), and it’s important to note that many of these pain treatments also have significant side effects.

Despite the seeming agreement among the street that safety levels are acceptable and that the benefits of a non-opioid drug for pain are significant, estimates still look conservative, as most brokers still have estimates ranging from $100 million to $300 million in 2021. As a result, tanezumab looks to have potential for further upside if the drug can continue to report positive safety data in the coming trial readouts.

Tafamidis. Tafamidis has seen a resurgence in investor interest after posting strong results for transthyretin cardiomyopathy in August of last year. The drug initially received a refusal-to-file letter and a complete response letter asking for more efficacy data for transthyretin amyloid polyneuropathy in the US. The drug has approval in Europe, Japan, and several other international markets to treat forms of transthyretin amyloid polyneuropathy.

In August 2018, Tafamidis reported strong data from its phase 3 ATTR-ACT trial in transthyretin cardiomyopathy. Data showed a 30% reduction in mortality and 32% reduction in cardiovascular related hospitalizations, well-above investor expectations. Consensus 2021 Tafamidis revenue estimates in July last year called for roughly $200 million of revenue. Today, consensus estimates sit at over $1 billion, largely due to the results presented in August.

Note that the actual number of patients with transthyretin cardiomyopathy is unknown, and Pfizer has estimated that less than 1% of cardiomyopathy patients have actually been diagnosed. If the drug receives approval, Pfizer will need to grow awareness and educate physicians and cardiologists. Pricing could be over $100k given the extensive cost associated with an untreated patient with cardiomyopathy. Pfizer has filed two applications to the FDA, and has a PDUFA date in July and in November this year.

Street Has Better Visibility Into Growth Beyond 2020 and Plenty of Upside Still Exists

Pfizer’s stock run since mid 2018 is an acknowledgment by the street that 1) the pipeline has strengthened significantly with numerous positive data readouts, and 2) LOE headwinds are beginning to subside. Going forward, Pfizer is positioned well to continue to outperform over the coming years with the potential for further upside than what expectations are currently baking in. Beyond the five assets mentioned here, Pfizer also has several other important sources of growth, including Eliquis and biosimilars. Overall, while the rising stock has brought with it rising expectations, the risk/reward continues to look favorable for Pfizer.