Stock Surges on Positive Alport Syndrome and ADPKD Data

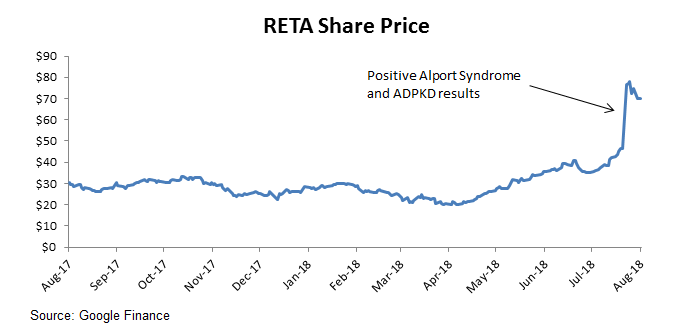

On July 23rd, Reata Pharmaceuticals surged 65% on more detailed results from its phase 2 trial studying bardoxolone's effects on Alport Syndrome and on autosomal dominant polycystic kidney disease (ADPKD). The stock has had a strong run prior to the news as well, increasing 133% since early April from positive results from other trials. I'll detail the reason behind the street's strong bullishness as well as the ongoing risks to the story.

Background on Bardoxolone

Reata's two main assets are bardoxolone methyl (bard) and omaveloxolone (omav). Both molecules bind to Keap1, an inhibitor protein, which then indirectly impacts two transcription factors: Nrf2 and NF-kB. Both of these transcription factors are key to enhancing energy production in the cell, and encouraging antioxidant and antinflammatory actions. We'll focus on bard in this article, and specifically, its impact on the kidneys.

Within the kidney, one of the early stages of blood filtration occurs in the glomerulus. The glomerulus has capillaries with two kinds of cells that play key roles in filtering the blood: endothelial cells and mesangial cells. When the endothelial cells and the mesangial cells become dysfunctional, kidney functions deteriorate. The pores between endothelial cells become more permeable, which increases protein spillage, and the blood filtering rate slows as the surface area contracts.

Bard acts by reversing endothelial dysfunction and mesangial overcontraction to improve renal function, reduce inflammation, and reduce fibrosis (scarring of the connective tissue). Given that inflammation and immune activation is a fundamental issue that exists for many acute and chronic kidney diseases (regardless of the initiating cause), a big part of bard's upside lies in its potential to target numerous indications.

The primary endpoint used in clinical trials studying chronic kidney disease is glomerular filtration rate (GFR). Trials often examine eGFR (estimated GFR), which uses creatinine as a proxy for GFR, but is notably an imperfect measure, as I'll detail next.

Hyperfiltration and Safety Issues Were the Biggest Concerns For the Stock

The stock languished for over a year prior to its recent surge due to investor concerns around safety and efficacy of the drug. There's two pieces to the story. The first piece is related to hyperfiltration. As mentioned previously, eGFR is an imperfect proxy for GFR and kidney function. Elevation in fluid retention and blood volume could lead to an increase in blood pressure, which increases eGFR, but actually damages the kidney as well. This is referred to as hyperfiltration. Concerns around hyperfiltration were elevated after the BEACON results in 2012, which showed elevated blood volume.

The second piece of the story is related to the safety levels seen in that same BEACON trial. The study was halted as the bard treatment group saw elevated levels of hospitalizations/deaths from heart failure. This has led investors to closely scrutinize safety levels in the drug.

Put together, bard was largely a show-me story for investors that needed strong conclusive evidence that it was safe and effective. The company's analysis after the BEACON trial found that the heart failure occurred in a very specific subset of patients with certain risk factors, and subsequently designed its following trials with this in mind. The FDA agreed with Reata's assessment and allowed the company to continue its clinical trials. More recently, Reata saw several positive datapoints from trials suggesting that hyperfiltration was not the cause, and showing normal safety levels. Despite all of this, the stock languished as investors awaited more detailed results that conclusively confirmed the safety and efficacy of the drug.

Investors were particularly focused on the retained benefit data from its phase 2 CARDINAL study on Alport Syndrome. The company looked at the impact of bard on eGFR after 48 weeks on the drug. Patients were then taken off the drug, and eGFR was again observed after 52 weeks. The goal was to see if the drug was really modifying the disease, or if increases in eGFR were simply due to hyperfiltration. If it was the former, results should continue to show some improvement in eGFR at 52 weeks. This analysis was seen as especially risky given the severity of Alport Syndrome, which damages the glomeruli structure.

Retained Benefit Data in Alport Syndrome Addressed These Concerns

Results from retained benefit portion of the study were well-above investor expectations and a strong rejection of the hyperfiltration argument. Given the severity of Alport Syndrome, an improvement of +1-2 mL/min in eGFR would have been seen positively. Reported results showed that patients continued to see an improvement of +4.1 mL/min at week 52. Given that these patients were historically losing 4.2 mL/min per year prior to the start of the drug, this implies a net benefit of +8.3 mL/min - a home run for Reata and strong evidence that the drug is improving the health of the kidney.

And to further add on to the evidence that hyperfiltration was not occurring, the data showed that there were no issues in urine albumin/creatinine ratio (UACR). There were also no drug-related adverse events and no safety concerns noted. This was seen in the Alport Syndrome results, as well as in the autosomal dominant polycystic kidney disease (ADPKD) data (which I'll detail later). These results are all inconsistent with what would be expected if the improvement in eGFR was due to hyperfiltration, thereby further weakening the bear thesis.

Alport Syndrome Revenue Expectations Move Up

Reata currently has a phase 3 trial studying the effect of bard on Alport Syndrome patients that is expected to readout in 2H19. The study is powered to detect a 2.2 mL/min difference, and the FDA is likely looking for a similar size impact for accelerated approval. Given the actual size seen in the phase 2 retained benefit portion, the phase 3 trial is now significantly derisked.

What impact does this have on analyst estimates for Reata? Alport Syndrome is one of three key indications that Reata is targeting for bard/omav, and many investors saw Alport Syndrome as the primary value driver for the stock in the near-term. Recall that the street models drugs using probability-weighted revenue. With the results, analysts have increased the probability of success (POS) on the drug to roughly 65-90% (with most of the estimates that I've seen at the high end of this), which then increased their revenue estimates for bard on Alport Syndrome. Analysts see a market potential for the drug of $500M-$1B, representing a significant portion of the company's total sales in the coming years.

Upside from Here Lies in Other Targeted Indications

As mentioned previously, the fundamental nature of bard's mechanism of action means that there are a number of indications that the drug could potentially treat. Perhaps the most important ones to watch in the near-term are the chronic kidney diseases. The company has a phase 2 PHOENIX trial that is examining bardoxolone's impact on four additional rare renal diseases: ADPKD (mentioned previously), IgA nephropathy (IgAN), type 1 diabetic chronic kidney disease (T1D CKD), and focal segmental glomerulosclerosis (FSGS).

The company has already reported promising data on several of these diseases. In late May, Reata reported positive interim results for ADPKD (+12 mL/min improvement by week 12) and for IgAN (+8.4 mL/min improvement by week 8) and no serious adverse events. Note that full ADPKD results were also released with the Alport Syndrome data, and showed no increase in proteinurea (indicating that increases in eGFR were not damaging the kidneys). Taken along with the Alport Syndrome results, Reata has shown that bardoxolone has a strong, consistent, and safe impact on eGFR and kidney function through numerous datapoints.

Looking ahead, there are still several upcoming catalysts that could move the stock significantly depending on the results in the near-term. At some point in 3Q18, the company will report full 12-week data on IgAN. Note that interim results showed 8-week data, and investors will expect the improvement to increase in the 12-week data, consistent with the trajectory shown in other indications. Additionally, the company will report full 12-week data for T1D CKD in 3Q18 as well. Importantly, investors will be closely watching for any safety issues. Next year, Reata expects to report full 12-week data for FSGS in 1H19, and then we expect to hear from the phase 3 Alport Syndrome study in 2H19 (for a table of the catalysts, see the end of this note).

What's in analyst estimates from the rare renal disease drugs? Investors see ADPKD and IgAN as 2-5x larger than the Alport Syndrome opportunity, but have not yet factored much in their revenue estimates. Based on what I've seen, and given the early nature of the results that we have seen so far, analysts have only factored in a 20-40% POS in ADPKD and have not yet factored in much for IgAN. This leaves upside opportunity to estimates and to the stock if results continue to show positively, as analysts will begin to increase revenue estimates as they bring these indications into their models.

Beyond the renal diseases, the company has several other promising indications in the pipeline. Reata is studying bard's impact on connective tissue disease-associated pulmonary arterial hypertension (CTD-PAH) in its CATALYST phase 3 trial. While the market for pulmonary arterial hypertension is crowded, the indication represents a major opportunity for the company given several key points of differentiation. First, bard's mechanism of action differs from the existing vasodilatory-specific drugs. Bard primarily aims to mitigate fibrosis, a key process in the CTD-PAH progression. Another key source of differentiation is that bard targets CTD-PAH specifically, whereas other vasodilatory drugs largely target pulmonary arterial hypertension (PAH). The company's phase 2 LARIAT study examined bard's impact on both indications and found a dramatic improvement on CTD-PAH patients with a 48.5M improvement in six-minute walk distance (the primary endpoint for PAH). Results from the CATALYST trial are expected to read out in 1H20, and analysts give it a 40-50% POS. The company is also studying an adjacent lung disease in pulmonary hypertension-interstitial lung disease, which also reported positive results in late March.

The other indication worth noting is Friedreich's Ataxia, a life-shortening neuromuscular disorder with no available treatment. Reata's other molecule, omav, again acts on Nrf2 and suppresses NF-kB to enhance ATP production and improve the handling of oxidative stress. Expect phase 2 results in 2H19.

Several Risks to the Stock Remain

As I have written for just about every stock, there is almost always a decent counterargument to consider and be wary of. In Reata's situation, the hyperfiltration bear thesis has been largely shot down, which has led to a significant increase in the stock. However, as with any stock that has risen significantly, the risk now shifts to high expectations that may skew the risk/reward to the downside.

Investors now largely expect bardoxolone approval in the treatment of Alport Syndrome when we hear the results from the phase 3 CARDINAL study in 2H19. No approval would be a huge blow to the stock. Additionally, investors now expect continued clean (i.e. no serious adverse events) results from many of the other indications, and are baking in some degree of success in many of the rare renal diseases. There would likely be a moderate blow to the stock, and perhaps a resurfacing of the safety bear thesis, if there are any issues in the trial results for IgAN, T1D CKD, or FSGS.

And just to further temper enthusiasm, signs of more moderate efficacy in the results could also further reduce the odds of FDA approval and market opportunity for the drugs. This is a risk in the upcoming phase 2 results, and is especially a risk in phase 3 results that will examine a much larger patient size (note that many of the phase 2 results had patient sizes of ~20-30).

Analysts Remain Bullish Despite Risks

Taking into account the risks, Wall Street remains very bullish on Reata. Numerous key opinion leaders have noted that they expect bardoxolone to produce positive results based on the underlying science. And despite the significant increase in the stock, analysts continue to see huge upside driven by bardoxolone's potential ability to address numerous indications, which are increasingly validated with every trial result that comes out. In the near-term, investors should watch for full 12-week data on IgAN and T1D CKD some time in 3Q18.