The Debate is Centered on Generic Advair and Other Drugs

One of the primary debates around Mylan is on its ability to bring complex generic drugs to market. This is an area that the company has touted its competitive strength, but has not seen strong results. Bears argue that Mylan has made numerous expensive investments (Meda, Renaissance, Abbott Established Products), and yet operating income and EBITDA remains roughly flat with 2016 levels. As further proof, we continue to see near-term issues as well with recent drugs (i.e. gAdvair, gCopaxone, detailed next). However, bulls argue that there is significant longer-term potential that the market is not fully realizing, and that investors will see evidence of this over the next several quarters.

Let's jump into the details of each drug.

Generic Advair. Generic Advair remains the primary focus/concern for many investors in Mylan. Mylan (and other manufacturers) are still in pursuit of a generic Advair after numerous failed attempts, as I've detailed in my previous writing on Mylan. The company first received a CRL back in March of last year, and then received another CRL in June over "minor deficiencies." Management has since noted that they are in the final stages of labeling discussions on their 3Q conference call, suggesting that approval could occur any day now. Analysts largely appear to be modeling a mid-November launch, with estimates for $20 million in 2018 and 2019 varying from $125 million to $300 million in revenue. On the negative side, the market for Advair has shrunk since Mylan initially began developing a generic - in 3Q, GSK noted that Advair sales were down 45% y/y. However, even with lower branded sales to take share from, the generic will still likely contribute meaningfully to revenue and earnings.

Generic Restasis. Restasis is a branded drug produced by Allergan for Chronic Dry Eye. It operates by increasing your eye's ability to produce tears, thereby reducing inflammation. The drug produced $1.5 billion in sales for Allergan in 2017 and represents a significant opportunity. However, as I have discussed in prior articles, the competitive landscape remains uncertain, as Teva and Akorn are both pursuing settlements with Allergan. Additionally, the opportunity is not as significant as other drivers, but it should be a contributor nonetheless. Analysts model around $2 to $10 million in 2018 and $20 - $50 million in sales in 2019. Recall that on the 2Q call, management noted that they had received a CRL from the FDA on minor clarifications, but had already sent their response. However, management did not provide an update on the 3Q call. Analysts seem to anticipate a decision this year.

Generic Revefenacin. Mylan just received approval for Yupelri (revefenacin), a once-daily inhalation solution for chronic obstructive pulmonary disease (COPD). This drug is not being discussed as frequently among analysts, but bulls see the drug as promising for several reasons. First, it is the only once-daily solution available (Sunovion's Lonhala Magnair is a twice-daily treatment). Second, it is compatible with standard jet nebulizers, whereas Lonhala requires a specific Magnair device. As a result, analysts are modeling a longer-term opportunity of several hundred million.

Generic Copaxone. Despite receiving an earlier-than-expected approval for a generic Copaxone last year, results have largely missed expectations as uptake has been slow. However, analysts noted that traction appears to be picking up after 3Q results, and share gains now sit in the mid-teens for the drug. Management noted that they are working on increasing payer access, and have seen a 5% pick up in market share between 2Q and 3Q. Copaxone could be turning the corner and could begin to see the revenue that analysts anticipated when the drug was first approved.

Fulphila. Mylan has begun to see strong traction out of the gate after launching its biosimilar Neulasta, Fulphila. Management noted that they now make up 8% of the pre-filled syringe segment. Note that Coherus recently received approval for its Neulasta biosimilar as well, which was widely expected by the market. Analysts are watching for more details from Coherus on their pricing strategy.

Other Topics Include Margin Performance and Morgantown Remediation

While the drugs are often times the main drivers of a stock, there are two other topics that are being discussed by investors: margins and Morgantown facility issues.

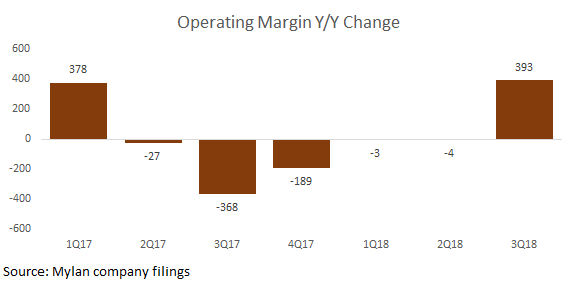

Mylan's 3Q results were significantly helped by its margin performance, showing investors that the company has a number of ways to outperform even if it does not achieve drug approvals in the near-term. In 3Q, gross margin expanded by 271 basis points vs. consensus expectations of a 141 basis point expansion. Management highlighted higher margin new product launches that contributed greatly to the outperformance (i.e. Fulphila). Secondly, management also called out savings related to the integration of its acquisitions, which benefitted R&D and SG&A. Operating margin overall improved by a whopping 393 basis points, and was a major factor behind the company's overall outperformance for the quarter. On the other hand, some bears have pointed to the R&D spend as slightly worrisome given that the company does not seem to be achieving strong returns on its investments in new drugs.

Secondly, Morgantown facility issues remain a concern among investors. Recall that in June, Mylan received a form 483 identifying several issues, including a lack of oversight and cleaning procedures. Management has said they would take steps to restructure and remediate the facility, and in 3Q the company incurred $98 million in charges (which was conveniently incurred in Other Special Items, and left out of adjusted earnings). However, it remains unclear how long the remediation will take place, and when we'll see a resolution to the issue.

It should be noted though that management did clarify that the facility was limited in its impact on their financials. Specifically, management noted that only one of their top ten, and eight of their top fifty gross margin products in North America were produced there. Additionally, the company does not expect any significant new product launches to occur from there in 2019.

Issues Remain, but Expectations Are Low and Bulls See Signs of Improvement

In sum, Mylan continues to face a number of issues, including a difficult generic environment, slow uptake of generic Copaxone, continued issues getting gAdvair and gRestasis to market (with 4Q guidance demonstrating the company's uncertainty), and an indefinite timeline for Morgantown remediation.

However, it's also important to remember that Mylan shares, even with the 3Q bounce, remain down by over 15% for the year and still trades at a roughly 25% discount to Teva shares. Expectations are low, and, if the company is able to finally get approval of gAdvair and gRestasis, its outlook could suddenly become much brighter. Additionally, some analysts do expect generics to eventually bottom given the importance they play in lowering healthcare costs and providing competition to the market. If these catalysts play out, the stock could see a strong reversal.