Adobe has shot through the roof, gaining 279% over the last 5 years. The stock has benefited primarily from the ongoing shift of marketing/media to the internet, as well as Adobe's product shift towards the cloud. As people's eyeballs move towards our screens, advertising and content creation is increasingly following it. In turn, people are increasingly demanding more tools to create, distribute, and analyze/optimize content. Adobe's suite of products are perfectly positioned to address these issues.

Given the stock's outperformance, I am going to spend a larger amount of time discussing what has driven recent performance and why investors are so bullish on the stock going forward. I'll then jump into the bear arguments.

Bulls tout the large growing market and benefits from the shift to the cloud

Digital Media Segment

Adobe's Digital Media segment is comprised primarily of Creative Cloud and its associated products. These apps help professional creatives create and edit content.

Context: Prior to 2012, the company was dependent on the product launch cycle. Back then, Adobe sold its products on a perpetual license - you pay a large one-time fee and you get the product forever. This led to very lumpy revenues as sales would jump when they released a new product, then tail off until the next product. It also led to a high degree of piracy given the high up-front cost (if you are familiar with the product, you probably know of at least one person who has pirated it), and a very limited audience that was able to enjoy the product.

In 2012, management shifted gears on pricing. They allowed people to pay a subscription fee for monthly/annual use of the product, and could access the product over the cloud. This led to some difficult years in the beginning, as new customers were now paying a significantly lower fee up front (prior model: up-front cost of owning the product forever; new model: up-front cost of access for one month). However, longer-term, Adobe was capturing more value. Finally, Adobe "bottomed out" in 2014 (the point at which the drop-off from perpetual licenses to cloud purchases were offset by recurring revenue). The company has now largely transitioned over to most of its customers to a subscription model and is now reaping the benefits, which include:

Stable revenue trends: now, fees are paid on a monthly/annual basis and are not based on the product cycle. This leads to higher revenue visibility.

Lower piracy: products are now priced with lower up-front costs. The barriers to accessing their products are lower, which now opens the addressable market to more casual users, and makes customers less likely to pirate the product.

Higher margins: Normally, software over the cloud would carry with it increased expense related to providing service over the cloud. However, Adobe is positioned favorably as many of its customers continue to use Adobe products on their own drives (and not on the cloud), while still paying the new pricing model. As a result, Adobe's cost structure remains the same, allowing them to benefit from increased leverage of sales and thereby higher margins.

Fewer resellers: Adobe also benefits from fewer resellers who might eat away at their margins. Now, the company sells more of its products directly to consumers, allowing them to hold onto profits.

More interaction with customers: Adobe is able to maintain a stronger, closer relationship with the customer as they now interact and engage more frequently with them. The prior model involved seeing the customer once for a large purchase before they disappeared offline.

Significantly broader addressable market: With monthly fees, more people can afford to use Adobe. This significantly increases the user base and revenue opportunities. In fact, Adobe noted that 35% of its users are new to Creative Cloud.

Major growth drivers going forward:

In addition to the benefits mentioned above, investors expect several factors to drive growth in the coming years:

Market growth: Estimates vary widely on the market size for content creation, from $5B (from IDC) to $20B (Adobe's figure). The truth is probably somewhere in the middle. Estimates are important as it implies how much upside there is for Adobe to capture. Growth estimates also vary widely from mid-single digits to mid-teen growth. The primary driver of the market growth is the continued shift of media online.

Market leading position: Adobe has a stranglehold on the content creation market as they provide tools that are considered must-have for creatives. As the market grows, Adobe is expected to grab much of the growth given their leading position. Some estimates place Adobe's market share at a commanding 70%.

New users that were previously priced out: With a larger TAM, Adobe is hoping to capture more users that were previously priced out of purchasing the Adobe product. Specifically, management highlighted photo hobbyists and mobile users as additional opportunities on top of their existing creative professional audience.

Upselling new customers: With lower tiered pricing, many users are being introduced to Adobe products at inexpensive prices. Adobe is using this opportunity to then introduce them to other products in their suite (in some cases, using promotions) and gradually upselling them. As an example, as a creative with a need to use Adobe InDesign and Photoshop, you might start out with their $50/month package for Creative Cloud. Adobe would then try to upsell Adobe Stock to you, which provides additional stock photos to users either for a fee per photo or for an extra $30 per month, or Adobe Typekit, which offers more fonts. Data points suggest that this strategy is working, as Adobe Stock has grown revenue by over 40% in 2016.

Margin expansion: As noted above, Adobe's cost structure for cloud customers is largely the same, but their pricing model allows the company to monetize its product more and broaden its addressable market. As a result, the company should drive significant margin expansion as more customers come onto the platform.

As a result of these numerous factors, investors are extremely bullish on the segment. Consensus estimates are for 23% growth in 2017 and 18% growth in 2018.

Digital Marketing

Adobe's Digital Marketing segment is comprised of marketing solutions, including analytics, social marketing, targeting, cross-channel campaign management, audience management, video delivery and monetization, and media optimization. It is a complete end-to-end tech solution for the marketing department.

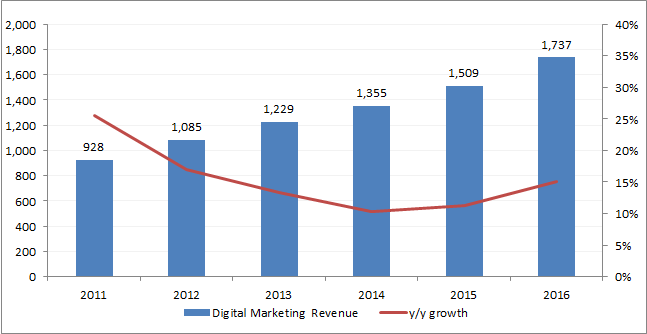

Context: The segment started in 2009 with the acquisition of Omniture, a data analytics company. Adobe has gradually built on this product through organic investment and M&A activity, purchasing a bevy of companies to build out their marketing tools and features. Today, the product operates in a more competitive environment than its digital media segment, competing with other large players such as Oracle, Salesforce, IBM, and Google. However, Adobe has also made impressive gains and now owns the largest market share in the industry at roughly 17% of the total market (compared to 12% for IBM and Salesforce, each).

Major growth factors going forward:

Unique position in the market: Most competitors in this space provide marketing tools along with sales and CRM tools (i.e. Salesforce, IBM), or alongside media distribution (Google). Adobe positions itself as a provider of marketing tools along with content creation tools. This is a unique position that only Adobe can offer given their strength in Media highlighted above. The company offers a strong end-to-end solution, from creation to distribution. Their position also provides Adobe with an advantage in penetrating new clients given their existing relationships with CMOs and advertising agencies.

Cross-selling: In 2014, 66% of Adobe's top 100 marketing customers had 3 or more products (of the company's 8 products), and an average annual recurring revenue (ARR) of $2.8 million. By 3Q16, this had grown to 90% of Adobe's top 100 accounts with an ARR of $4.4 million. The company has a broad product suite and has been able to effectively cross-sell those products to their existing customer base.

Market growth: Adobe's Digital Marketing segment operates in a large and fast-growing space. The total addressable market estimates vary from roughly $20 billion to $30 billion. Additionally, the market is expected to grow in the low double digits, according to industry experts. Gartner expects digital spending to increase from 18% of IT budget to 28% by 2018 as CIOs shift IT budgets towards digital channels. And several banks have forecasted even higher growth for the market as companies shift their marketing strategies towards the online channel.

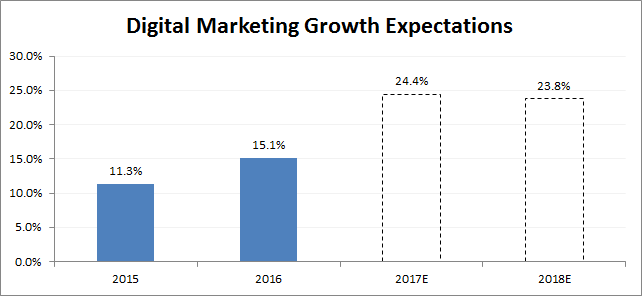

As a result of these factors, investors expect 24% growth in both 2017 and 2018 from the segment. While the growth is higher than the Digital Media segment, note that Digital Marketing is less than half its size in revenue, and therefore contributes less to the company's overall revenue growth.

Bears do not like the risk/reward as expectations have crept higher

In general, the bears admit that Adobe's fundamentals have had impressive growth and tailwinds behind them. However, as is usually the case with high growth stocks like Adobe, bears believe expectations are starting to get ahead of the company's prospects and do not like the risk/reward profile. With such high valuation, something like 15% growth vs. expectations of 20% (illustrative figures) would be a big hit to the stock.

Valuation and high expectations: As shown in the above charts, investor expectations have crept up with each quarter beat, and Adobe's segments are now baking in high growth estimates. These high expectations are seen in its valuation as well, where ADBE trades at 30x PE NTM and 25x EV/FCF estimates. In order for the stock to move higher, the company will need to at least achieve consensus estimates. Digital media in particular will most likely need to get above 20% growth for 2018. Any signs of a slowdown will hurt the stock significantly.

Shift towards lower priced products: While cross-selling is an opportunity for the company, there is some evidence (in the form of declining ARR / customer) that shows pricing pressure more than offsetting any potential upselling in Digital Media. New customers are coming in at lower price points, which could weigh on revenue trends to a greater degree than investors are expecting.

Competition in Digital Marketing is heating up: Competition in the Digital Marketing segment is more fierce than in Digital Media, where Salesforce and Oracle are in a heated race to acquire more tools and products to fill their enterprise product suite. Salesforce alone has acquired ExactTarget for $2.5B in 2013 and Demandware for $2.8b in 2016. With significant M&A activity and differing positions in the space, it's unclear who will win. Adobe's segment is likely to continue to grow, but the key question is whether they will be able to continue to hit higher investor expectations for the segment as competition simultaneously increases as well.