NOTE (11/1/18): Looking at this article almost 2 years later, I’m realizing that it’s not the most intuitive thing in the world. I’ll leave it up until I can find a better way to make this argument. Expect more hot-pink charts.

Buying a home is an embedded part of a successful American life. It's seen as a career milestone ("Congrats on buying a new home!"), a good investment ("home prices always go up"), and a sign of increased security ("you will always have a place to live").

Many of these conceptions are misguided. Buying a home is no different than any other significant investment that you might make. In fact, it actually has numerous characteristics that make it less attractive than other options that you would have to use that money.

To understand this argument, there's two points to understand:

1) Buying a home and living in it is the equivalent of buying a home, renting it out, and then renting an apartment yourself.

2) Buying a home and living in it, then, is the equivalent of making an investment in something else (stocks, bonds, real estate, etc.), and then renting out an apartment yourself. And for the majority of people out there, buying a home and living in it doesn't stack up that well to other alternative investment options.

Before I go into these points, I want to make one clarification as I want to be very clear here about the point I'm making. I'm not arguing that buying a home is flat out a bad decision to make - just that there are better options and ways to spend that money. So let's jump into the details.

1) Buying a home and living in it is the equivalent of buying a home, renting it out, and then renting an apartment yourself

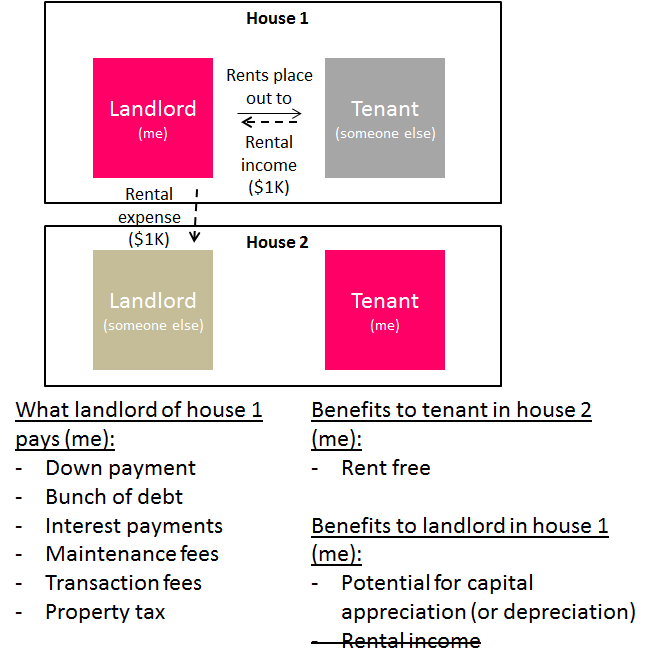

When we buy a home, this is how a lot of us might imagine it.

Apologies for the unorthodox colors and the ugliness of this chart

But, in every home, there is always a landlord and a tenant. In this situation, let’s label who they are. When you buy a home, you’re actually both the landlord and the tenant.

One of the commonly cited benefits of buying a home is not having to pay rent. In reality, the rent is only “free” because as both tenant and landlord, you are essentially paying the rental amount to yourself. In our example, you’re paying $1K in rent as the tenant and receiving $1K in rent as the landlord. In other words, you are only getting free rent because you are foregoing rental income as a landlord. And that's not really free at all; it's an opportunity cost.

Now let’s say you rent out the place instead of living there. You now get $1K in income from the new tenant. And of course you need a place to live, so you live somewhere else that’s just as spacious and in just as nice of a neighborhood, which would cost you the same $1K in rent (for illustrative purposes). So you take your income from the home you own, and pay it towards the rent of the place that you are living in.

Look back at the first image and the image below. We've replicated the same situation, in terms of benefits, as when you first lived in the home that you bought. You are now living essentially rent free (as you divert rental income from the home you bought to pay off your rental expense in the place you're renting) and you get the capital appreciation that would come from your first home - the exact same situation as if you had bought a home and lived in it.

2) Buying a home and living in it is the equivalent of making an investment in something else and then renting an apartment yourself

Point 1 was that buying a home and living in it is the same as buying a home as an investment (renting it out to someone else) and living somewhere else.

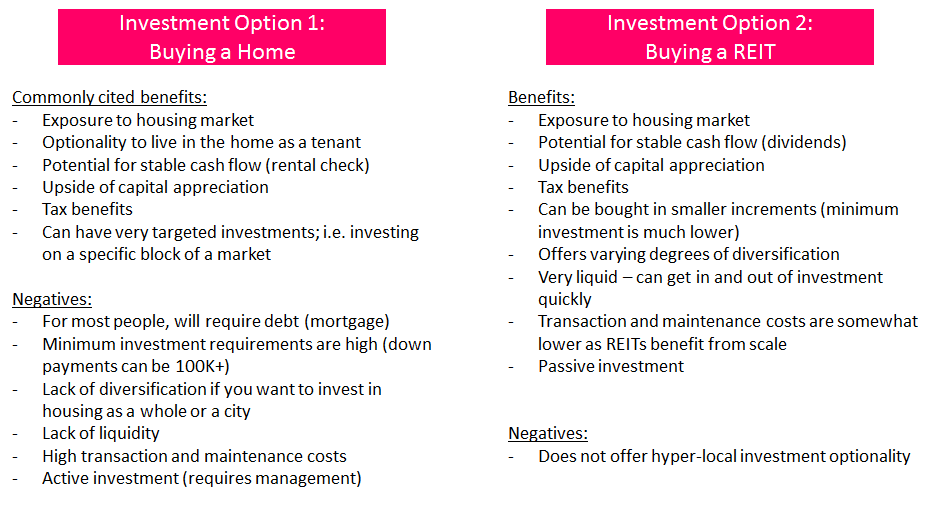

Point 2 is that buying a home then is essentially the same as any other investment with a return. Buying a home and renting it out to someone else IS investing in real estate. Investing in real estate is a decision that requires weighing the risk and reward, just as any investment decision would. You pay a bunch of money to buy a home, and you generate a return (rental income + capital appreciation) in exchange for risk (price goes down, home can’t be rented out, needs repairs, etc). So let's take the situation illustrated in Point 1 and call it "Investment Option 1".

If it’s an investment, then as prudent investors, we should be considering how this investment stacks up against other options. After all, we could be investing this money in other things like your favorite company, a mutual fund, or a business idea that you have.

Some of you might think that housing is a great (or even the greatest) investment for a variety of reasons that may or may not be true - home prices always go up, supply is low, etc. I want to set aside this question of whether real estate is a good investment for now, as it would sidetrack this post too much. That’s a separate topic and post that can be addressed as a later time. More importantly, buying a home is not the best decision even if you believe real estate is an amazing investment. Why is that? Because there are other investment options that will allow you to benefit from that belief without having to buy a home. If your goal is to invest and capitalize on the real estate market, you can do so through REITs, which offer many more benefits than buying a specific home.

Let's first talk a bit about what a REIT is. A REIT is a real estate investment trust. When you invest in a REIT, you are investing in a company that buys and manages real estate. There are two ways in which you financially benefit from a REIT that make it financially equivalent to buying a home:

1) Capital appreciation. The stock price of the REIT will be tied to the value of the properties that it owns. If the properties increase in value, then the value of the REIT will increase. This is essentially the same capital appreciation opportunity that you would get if you were to buy a home and hope for the price to go up.

2) Dividends. The properties that are owned by the REIT generate rental income, just as a home might. And the REIT is obligated to return at least 90% of its income to shareholders in order to remain classified as a REIT. So you'll get a dividend check each quarter that comes from the rental income from the properties that the REIT owns. This is similar to the income you might earn if you had bought a home and rented it out.

So as an example, if a REIT owns properties that appreciated by 10% in value over the last year, you'll likely see that the REIT has gone up around that same amount as well. And if the underlying properties are generating rental income that's 10% of what the properties were paid for, you might see a dividend from the company that's somewhat in line with that number as well.

I believe that for most people, this is actually a better investment option than buying a home for the following reasons:

Let's talk through some of key downsides to buying a home that don't exist with buying a REIT, as this enormous block of text probably doesn't do it justice.

- High minimum investment requirements. When you buy a home, you'll need to put down a pretty big down payment. If you're buying a REIT, you can put as little or as much into it as you'd like. So you can start benefiting immediately.

- Lack of diversification. When you throw that huge chunk of cash into a home, it'll all be locked into one home, which carries very specific geography risk. Think about owning a home in Detroit in 2009, for example. Some cities can change very drastically longer-term, for better or for worse. A REIT will offer more geographic diversification.

- Lack of liquidity. A home can't be sold very quickly. If you need the cash for whatever reason, you'll need to first find a buyer, then deal with all the paperwork associated with selling a home. A REIT can be sold within the next 5 minutes.

- Debt/Flexibility. For most people, buying a home will involve a mortgage. Debt isn't necessarily bad but it does burden you with interest payments and less flexibility. If you have a mortgage, you have to make sure that anything you do in the future takes into account covering those interest payments. So this means that you might hesitate to take half a year off to travel the world. Or you might not be able to take that dream job that pays $70K per year because it's not enough to cover your obligations. Or you might not be able to take that dream job because it's in San Francisco, and you want to stay near your home in Atlanta. A home ties you down, financially and mentally.

- Active investment. Owning a home either to live in or rent out takes a lot of time. If anything breaks, you're going to have to deal with it. Yes, you can hire a property manager if you are renting out the property. But then that comes at a cost. And you will still have to deal with certain aspects of the property. Meanwhile, a REIT is completely passive; you buy the stock, and you get rental income. That's it.

But does this play out in real life?

For most people, if they truly want to make a bet on housing with their money, they should be buying a REIT ETF (we'll use VNQ as the example here) instead of buying a home. But we all know a buddy or two who have made hundreds of thousands of dollars off of buying homes. And investing in a REIT ETF doesn't seem like it would do that. So how does this strategy perform vs. buying a home in real life? Comparably well:

This chart shows two scenarios. On the left is if you bought a home 5 years ago (in all cash, to make the scenarios comparable). You'd spend $164,000, and today, it would be worth $280,210* if you sold your home and took into account rental income.

Now let's assume that you had bought the VNQ (a REIT ETF) instead with that cash five years ago (the right column). Today, it'd be worth $291,192, taking into account dividends.

Some might counter that the stock market is much riskier. The chart below shows what owning the VNQ looks like over the last 5 years vs. the median price of a home. It's fairly similar.

So it turns out that owning the VNQ compares pretty favorably to actually buying a home. Parking your money in the VNQ and then using the dividends to fund your rental income would have been very similar to actually owning your own home. Additionally, you get other benefits such as diversification, not having to worry about home ownership headaches like repairs, and the flexibility to move around to other cities for whatever reason (employment, for fun, etc).

This conclusion probably seems a bit counter-intuitive and surprising to many people. But if we truly think about it, nothing is that surprising. A big reason why people are able to make so much money on their home is because they are throwing a huge amount of money into it. If you had done something similar with something like Facebook stock, or a mixture of stocks and bonds, you would have also made a lot of money. People just don't think of buying a home as being similar to those other options. They don't consider the opportunity cost of buying a home.

Additionally, if buying a home truly was that much better than other investments, then simple market economics would have arbitraged that benefit away very quickly. Active money managers like Warren Buffet would have spotted the market inefficiency in homes, bought them all up using the billions of dollars they manage, and then profited from its superior returns. Over time, with the rush of money into the asset class, the prices would move up until the risk/reward was balanced. And this is essentially what has happened with housing over the years. The housing market today is an efficient market where homes are priced accurately and fairly, and it's very hard to find any remaining home-run investment opportunities.

So next time you're thinking about buying a home, consider the many other options that are available to you as an investor. You might be better off throwing that money into a REIT and living the rest of your life as a rent-free nomad.

*Some people might question my 5% dividend yield for a home. I've used a 5% return because I am assuming that the home is bought out in all cash. An all-cash investment in a home will have a lower cap rate since it doesn't benefit from leverage.